SHAHEDNEWS; Buying a downturn in bitcoin may be a profitable strategy, but needs careful preparation and execution. Instead of jumping in blindly, intelligent investors evaluate market circumstances, identify risk, and establish clear entry points.

According to SHAHEDNEWS, "Buy the dip!" It's a term that appears on social media every time the bitcoin market falls. But what exactly does it mean, and how can you employ this technique to maximize profits while avoiding risk?

Buying the dip is the practice of acquiring assets after their prices have fallen, with the belief that they would recover and rise higher. While it may appear basic, success necessitates a deliberate approach. Because cryptocurrencies are so volatile, purchasing on a drop might result in large losses.

Buying the dip is more than just purchasing when prices fall; it's about buying strategically. A real dip happens when the price of a cryptocurrency falls momentarily owing to market emotion, external events, or corrections, rather than fundamental defects in the asset itself. Types of Dips:

1. Market Corrections: Short-term decreases in an overall upswing (for example, Bitcoin dropping from $60,000 to $50,000 during a bull market).

2. News-Driven Dips: Decreases induced by unfavorable headlines (for example, regulatory crackdowns or exchange hacking).

3. Bear Market Dips: Prolonged declines during bearish market cycles.

Key Questions to Ask: Is this a short-term correction in a robust market, or an indication of more serious issues?

Before purchasing the drop, consider the overall market environment:

Market Sentiment: Are traders optimistic or pessimistic? The Fear & Greed Index, for example, can assist assess public opinion.

Historic Performance: Consider how the asset has performed during previous drops. Is there a history of robust recoveries?

Economic Events: Consider how macroeconomic issues (such as interest rates and inflation) affect cryptocurrencies.

During the COVID-19 market crisis in March 2020, Bitcoin temporarily fell below $4,000 before recovering strongly within months, indicating a classic buy-the-dip opportunity.

Evaluate the cryptocurrency's underlying value:

- Use Case: Does it address a genuine issue (e.g., Ethereum's smart contracts)?

- Adoption: Is the user base increasing?

- Development: Are developers actively working to improve the project?

Technical Analysis:

Identify critical levels using charts.

- Support Level: Areas where prices have historically stabilized following a decline.

- RSI (Relative Strength Index): Determines if an asset is overbought or oversold. A reading under 30 indicates a possible purchasing opportunity.

- Moving Averages: Watch for declines near the 200-day moving average, which is a popular support level in cryptocurrency markets.

Combine fundamental and technical research to establish that the decline represents a purchasing opportunity rather than a failing enterprise.

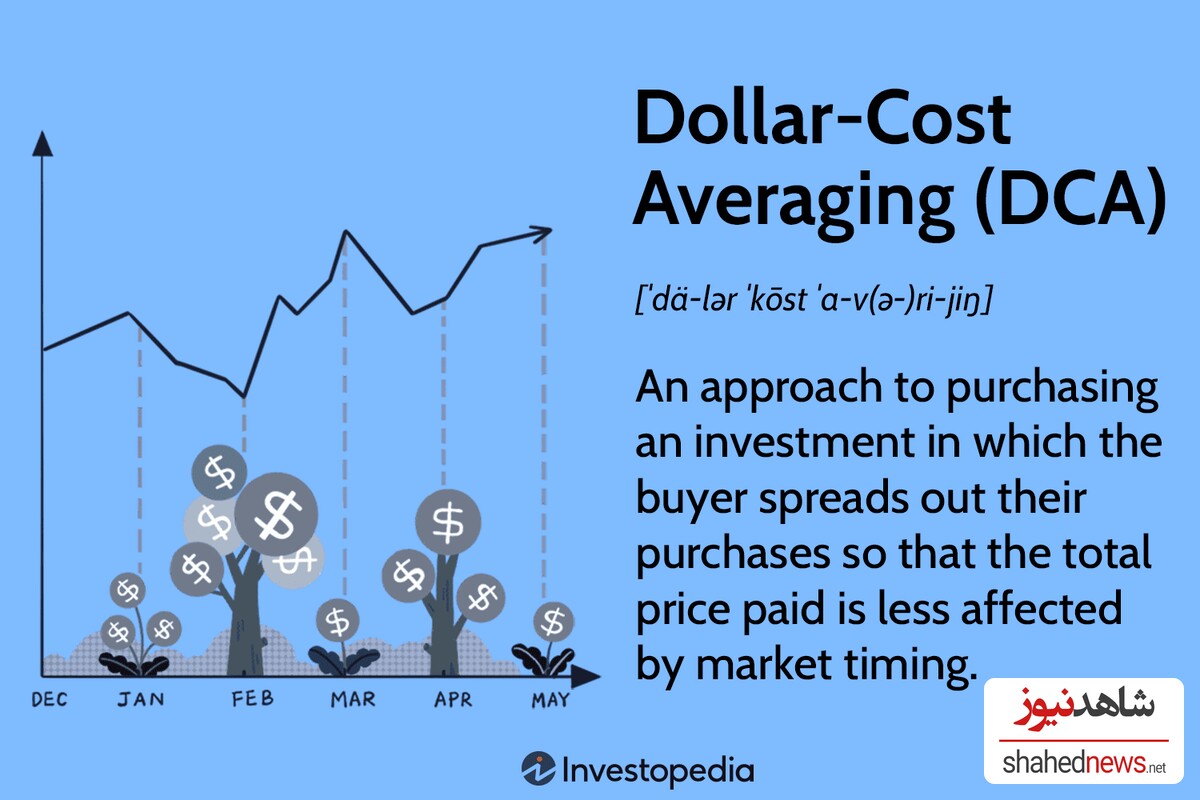

Are you looking for long-term growth or short-term profit? Your aims will shape your strategy. Determine certain pricing points where you intend to buy. Avoid chasing the market and stick to your predetermined goals. Instead of investing all at once, make your purchases over time. DCA decreases the danger of buying at the incorrect moment while also smoothing out price volatility.

Example: If Ethereum falls from $2,000 to $1,500, spend $500 weekly rather than making a single $2,000 purchase.

Invest just what you can afford to lose. Crypto markets are inherently hazardous, and no approach will ensure success.

Do not invest all of your money into one cryptocurrency. Diversify your investments among assets with robust foundations. Protect your capital by placing stop-loss orders at a certain percentage below the buying price. It's tempting to worry during steep falls or feel overconfident during recoveries. Stick to your goal and avoid making rash judgments.

Example: When Bitcoin plunged 50% in May 2021, diligent investors who stuck to their plan avoided panic selling and profited during the ensuing rebound.

Follow expert traders and analysts to get knowledge about market movements. Platforms such as Twitter, Reddit, and TradingView are excellent sources of information; nevertheless, constantly check claims and avoid mindlessly accepting advice. In 2023, seasoned traders emphasized Solana's durability following a substantial decline, noting developer activity and ecosystem expansion as factors for its future rebound. When Solana recovered, investors who followed this thesis profited handsomely.

Not every downturn is worth purchasing. Be wary if the cryptocurrency has poor fundamentals, such as no use case or diminishing popularity.

- There is ambiguity regarding regulatory compliance.

- Market mood is extremely pessimistic, with no indications of turnaround.

Example: Terra's 2022 collapse acted as a cautionary tale. Despite initial setbacks, the project's poor design resulted in a total collapse.

1. Buying Without Research: To avoid FOMO (fear of missing out), undertake due research before investing.

2. Ignoring costs: High trading costs can reduce earnings, particularly for frequent transactions.

3. Overleveraging: Using borrowed funds increases risk and might result in considerable losses during volatile periods.

4. Failing to Take Profits: Set reasonable profit objectives and adhere to them.

Buying the dip is more than just a catchy slogan; it's a strategy that takes discipline, research, and a well-defined plan. Understanding market dynamics, undertaking rigorous analysis, and managing risk may help you convert market downturns into opportunities. Remember that patience and preparedness are your strongest allies in the turbulent world of cryptocurrencies. So, the next time the market declines, take a deep breath, assess the situation, and make an informed choice. With the appropriate strategy, you'll be well on your way to becoming an experienced cryptocurrency investor.